Syllabus |

Home |

Class Resources |

News |

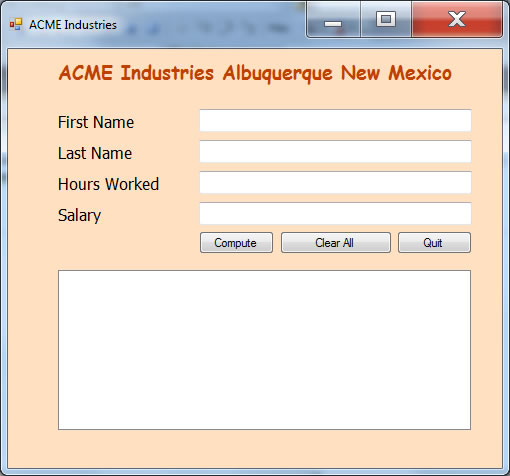

CS-100 In-Class Project: Employee ID

Instructions:

The form above is used to enter information about an employee and to serve as a receipt of wages. Write a program that will accept and save all employee information in appropriate variables. Then compute the following information:

1. Gross Income: (Salary times hours worked)

2. Federal Tax: (Gross times 15%)

3. State Tax: (Gross times 5.5%)

4. FICA: (Gross times 9%)

5. Total Pay: (Gross Income minus deductions)

Create the full name by concatenating first name and last name. Write the full name Gross Income, taxes, FICA and net pay to the list box..

Downoad the zip file with the form here.